Your Lawyer for Applying for European Certificates of Succession Across Germany

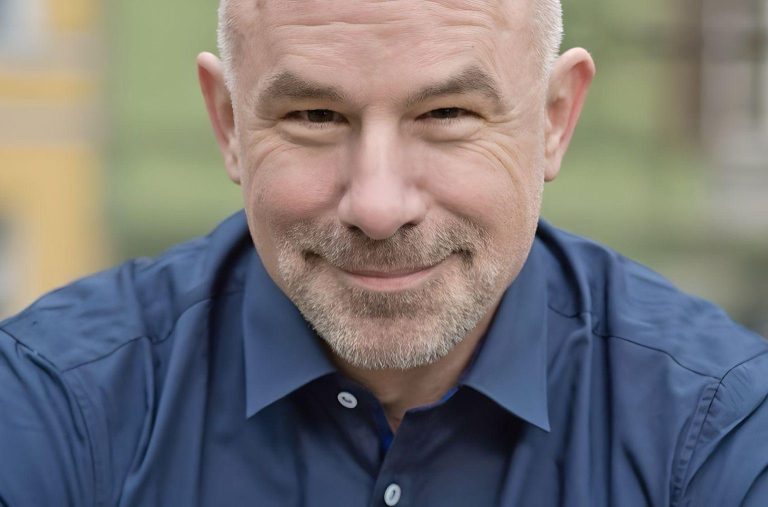

I am here to assist you if you need a European Certificate of Succession.

Welcome to Your Expert for European Certificates of Succession

Welcome to our website!

The European Certificate of Succession was introduced with the implementation of the European Succession Regulation on August 15, 2015, and since then, it has been THE tool to simplify the handling of cross-border inheritances within the EU (with the exception of Denmark and Ireland).

While a few enthusiasts like myself eagerly awaited the regulation's implementation and delved into its complexities beforehand, recognizing the opportunities and looking forward to the challenges, to this day, many courts, notaries, and legal colleagues are unaware of its existence—let alone how and when to use it.

This is unfortunate, but it may also stem from a populist EU skepticism, a fear of the new, and the mistaken belief that foreign languages are required. Of course, you don’t need to speak any "foreign language"; you just need to understand a few legal terms ("deceased," "estate," "legacy," etc.).

And you need to know how to navigate the truly dreadful application form (best handled by throwing it in the trash).

But before you, as a legal layperson, try to figure it out or consult lawyers who are unfamiliar with this field, you should turn to someone who truly knows what they’re doing.

Contact me today!

Leverage my expertise to avoid unnecessary stress and effort. Fill out the contact form or call me directly to discuss your situation. Together, we’ll find the best way to obtain and properly use your European Certificate of Succession.

How to Obtain a European Certificate of Succession in Germany?

The Procedure for Obtaining a European Certificate of Succession in Germany

The procedure for applying for a European Certificate of Succession (ECS) in Germany follows these steps:

1. Jurisdiction and Application Submission

- The competent authority for issuing a European Certificate of Succession is usually the probate court at the last habitual residence of the deceased in Germany.

- The application can be submitted by heirs, executors of the will, or estate administrators. A specific form must be completed, containing all relevant information, including:

- Identity of the deceased (name, date of birth, last habitual residence),

- Identity of the heirs and their shares,

- Information on the execution of the will, if applicable.

2. Supporting Documents

- In addition to the application, numerous supporting documents must be submitted, such as:

- Death certificate of the deceased,

- Wills or inheritance contracts,

- Certificates of inheritance or other court decisions concerning the estate.

- In certain cases, other documents may also be required, such as the heirs' birth and marriage certificates.

3. Review by the Probate Court

- The probate court reviews the application and the submitted documents to determine whether the information is correct and whether European inheritance law applies under the EU Succession Regulation (Regulation (EU) No. 650/2012).

- The authority may request additional documents or information if there are ambiguities and may also contact the parties involved for clarification.

4. Issuance of the European Certificate of Succession

- If all the requirements are met, the European Certificate of Succession is issued. It contains important information such as:

- The names of the heirs and their shares in the inheritance,

- The powers of the executor or estate administrator,

- The distribution of the estate, if applicable.

- The certificate is valid in all EU member states (except Denmark, Ireland, and the United Kingdom).

5. Validity and Use

- The European Certificate of Succession is generally valid for six months, but it can be extended.

- It serves as proof of the heirs' and administrators' rights and duties in connection with the estate, facilitating cross-border inheritance matters, such as the transfer of real estate or the closure of bank accounts in other EU countries.

6. Costs

- The costs of the procedure depend on the size of the estate and the complexity of the case. Fees are usually governed by the Court and Notary Fees Act (GNotKG).

A European Certificate of Succession significantly simplifies the settlement of cross-border inheritances within the EU and serves as a streamlined process for proving inheritance rights.

What does it cost to hire a lawyer to obtain a European Certificate of Succession?

The conventional way to obtain a European Certificate of Succession (ECS) is through a notary, who certifies the affidavit and submits the application to the court.

However, in my practice, I frequently encounter clients who struggle to find a notary competent enough to handle this task, particularly in smaller, more remote areas.

Additionally, the case may be somewhat "complicated," requiring preparatory work for the notary.

To avoid unnecessary costs—especially if both the notary and the court are involved and not just the court—I am happy to offer you a reasonable flat fee, reflecting the effort on my part and the benefit to you.

One key question for obtaining a European Certificate of Succession: What is the habitual residence?

Since the European Succession Regulation came into effect, the "habitual residence" of the deceased is the sole decisive criterion for determining which inheritance law applies to the case. It is no longer, as it was in the past within the EU and still is today in many countries outside the EU (and possibly in Denmark and Ireland), based on nationality.

The only exception is if a so-called "choice of law" has been made in the will, meaning that the deceased expressly stated, for example: "German law shall apply to my estate." In that case, even if the habitual residence was in Austria, German law would still apply. However, such a choice of law is only permissible in favor of the law of the deceased's nationality. So, a German national can opt for German law but not, for example, Italian law.

Otherwise, only the habitual residence of the deceased at the time before death is relevant. This habitual residence is decisive for the entire estate, regardless of how scattered it may be across the EU. This includes real estate located in another member state.

But what exactly is "habitual residence"?

The habitual residence, according to the European Succession Regulation (EUSuccReg), is the place where a person had their center of life at the time of death. It is based on the actual living circumstances, not just a formal registration or legal residence. I always ask my clients: Where was the deceased "at home"? If they were on holiday and told their relatives: "Tomorrow I’m going home!" – which place were they referring to? That is likely the habitual residence.

But let’s approach this question more systematically:

To determine the habitual residence, several factors are considered, including:

- **Duration and regularity of stay**: How long and continuously did the person live at this place?

- **Living circumstances**: Where was the center of the person's personal, family, and professional relationships?

- **Integration**: How deeply was the person integrated into the social and cultural environment of this place?

- **Intention to continue the stay**: Are there indications that the person intended to remain there permanently?

Several important aspects are considered:

The "habitual residence" is a qualitative concept, not a quantitative one! It's not about counting days in a year, but about assessing the quality of the person's stay at the place. Was it their "home"? Did they intend to stay there? The European Court of Justice speaks of the "animus manendi," the "intention to stay."

Formal aspects, such as where the person was registered, where they received their pension, or where they paid taxes, can be indicators but nothing more.

In my experience with approximately 150 cases involving the application of the term "habitual residence," I only failed once to determine the habitual residence to my satisfaction. That was because the client—the deceased's son—lived on the other side of the world and had only sporadic contact with his father. We simply lacked the factual knowledge, making it difficult to work. In that case, the decision was between Austria (our view) and Hungary (the widow’s view). This was crucial because the son had been disinherited and was now fighting for his compulsory share, which is half of the statutory share in Austria, but only one-third in Hungary. Fortunately for the son, we were able to agree on a lump sum with the opposing party, so the question of habitual residence did not need to be decided. In this case, all parties acted fairly, which is unfortunately not always the case.

The facts to determine where the habitual residence was must be provided by you. We will then evaluate them and present them to the court.

I hope these explanations have provided helpful guidance for your considerations!

Your Questions

Our Answers

Here you can return to the homepage, where you will find all legal areas, languages, contact forms, and FAQs.

Some legal information

Here you will find the information we wish to provide to help you understand your rights. If you cannot find something you think should be here, please feel free to contact us. We have taken great care to include guidance on each of our pages so that you don’t have to search for long.

Wir benötigen Ihre Zustimmung zum Laden der Übersetzungen

Wir nutzen einen Drittanbieter-Service, um den Inhalt der Website zu übersetzen, der möglicherweise Daten über Ihre Aktivitäten sammelt. Bitte überprüfen Sie die Details in der Datenschutzerklärung und akzeptieren Sie den Dienst, um die Übersetzungen zu sehen.